Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. NFT Doge Pets - Potential for Mass Adoption.

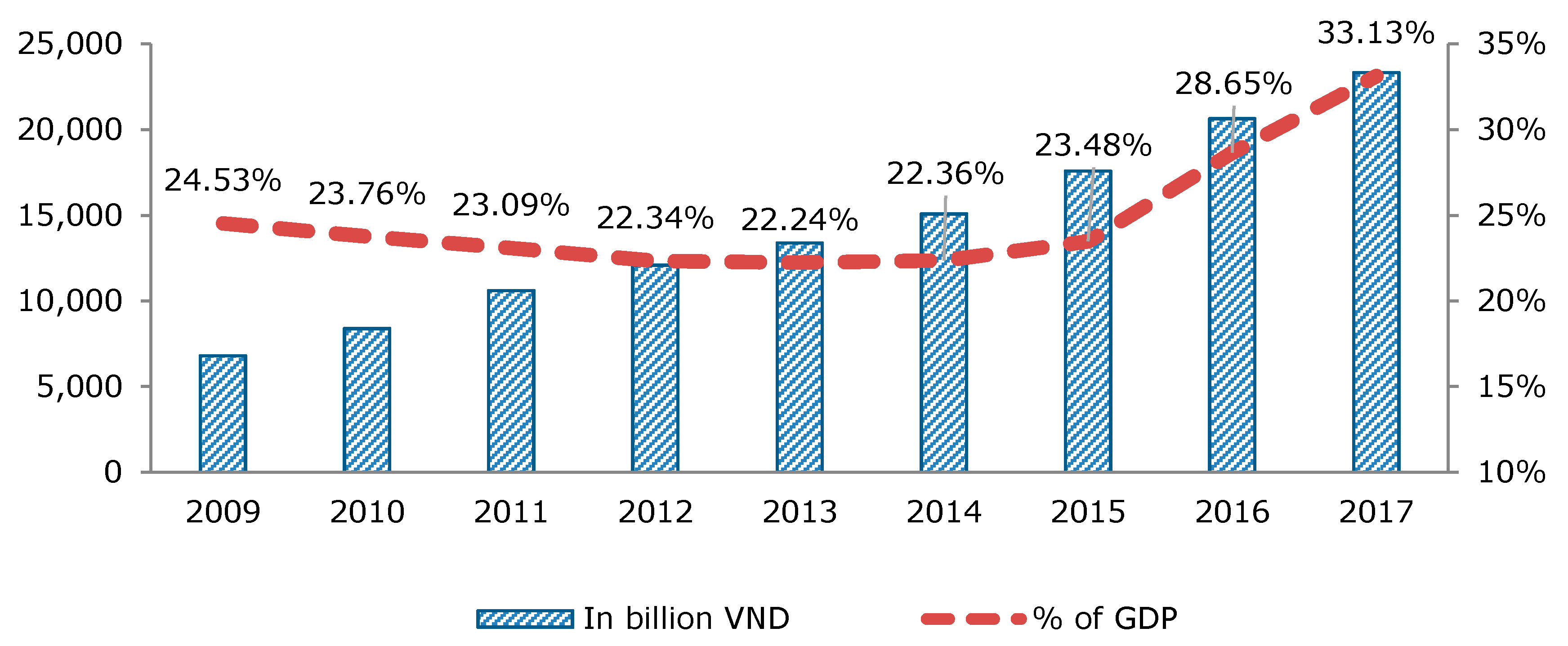

Economies Free Full Text Impact Of Monetary Policy On Private Investment Evidence From Vietnam S Provincial Data Html

For a person located in an international financial services centre deriving income solely in convertible foreign exchange one shall be liable to pay tax on such income at the rate of 9 plus surcharge and health and.

. However for 30 or more of new species the literature suggests various drivers deemed to be associated with their emergence at the present time. Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. A corporation is deemed to be subject to Israeli taxes if its activities are managed and controlled.

The recipient owns more than a 10 interest in the payer unless the payer was entitled to a refund of tax in respect of the dividend. Hartalega the biggest drag on the index fell 694 or 17 sen to RM228 its lowest since May 2017. The extract from the act is mentioned below.

A tax treaty between Malaysia and the recipients country of residence may reduce the rate of. Headline inflation hit 94 in June and the Governor of the Bank of England Andrew Bailey has hinted a 05 percentage point interest rate rise to 175 per cent could be on the way. Riverview lost 15 sen to RM331 Khind eased 10 sen to RM285 and Harrisons declined seven sen.

The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011Act 732 Minimum Wages Order 2020. The tax is not imposed if the recipient is connected to the payer ie. Islamic banking Islamic finance Arabic.

Deflationary Low Supply - 2 Billion. 2017 the rate was lowered to 24 with an additional reduction on January 1 2018 to 23. 1 Every establishment having fifty or more employees shall have the facility of créche.

She said the monetary policy stance remains accommodative and supports economic growth in a stable price environment. Value-added tax VAT in Israel is applied to most goods and services including imported goods and services. As of 1 October 2015 the standard was lowered to 17 from 18.

In the 2017 amendment of the government under section 11A of the act it was inserted that there should be crèche facility in any establishment having more than fifty employees and the employee shall be allowed to visit the crèche four times a day. These drivers can be considered within a framework originally suggested by the Institute of Medicine IOM 2003 noting that this framework was devised with reference to all emerging and re-emerging infectious diseases. BANK Negara Malaysia BNM is unlikely to take an aggressive stance in adjusting the Overnight Policy Rate OPR to return to pre-pandemic levels said governor Tan Sri Nor Shamsiah Mohd Yunus picture.

There is a tripartite body known as the National Wages Consultative Council which is formed to. Move to Earn Metaverse Integration on Roadmap. The formal rules that apply to a representative action in Malaysia is Order 15 rule 12 of the Rules of Court 2012 which provides that proceedings may be filed by or against one or more persons.

When the recipient pays dividends to its shareholders the tax is refundable at a rate of 38⅓ of taxable dividends paid. Beta Sale Ends Sept 2022 - tamadogeio. The taxpayer is liable to pay tax on such income at a rate of 185 plus surcharge and health and education cess on the adjusted total income.

مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. Interest paid or credited to any person who is not a tax-resident in Malaysia other than interest attributable to a business carried on by such person in Malaysia is generally subject to Malaysian WHT at the rate of 15 percent on the gross amount.

Malaysia Interest Rate Malaysia Economy Forecast Outlook

Malaysia Savings Percent Of Gdp Data Chart Theglobaleconomy Com

Asean Indonesia Malaysia Philippines Singapore Thailand Brunei Vietnam Laos Myanmar Burma Map Infographics Inkscape Vector Asia Southeastasia

Towards Sustainable Transport Policy Framework A Rail Based Transit System In Klang Valley Malaysia Plos One

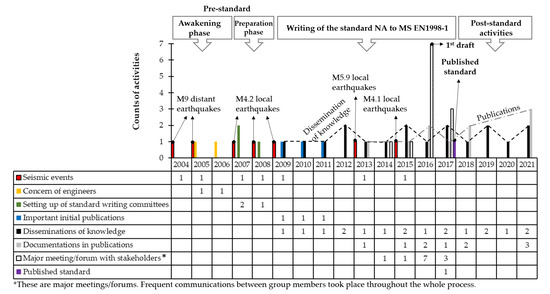

Standards Free Full Text Developing Earthquake Resistant Structural Design Standard For Malaysia Based On Eurocode 8 Challenges And Recommendations Html

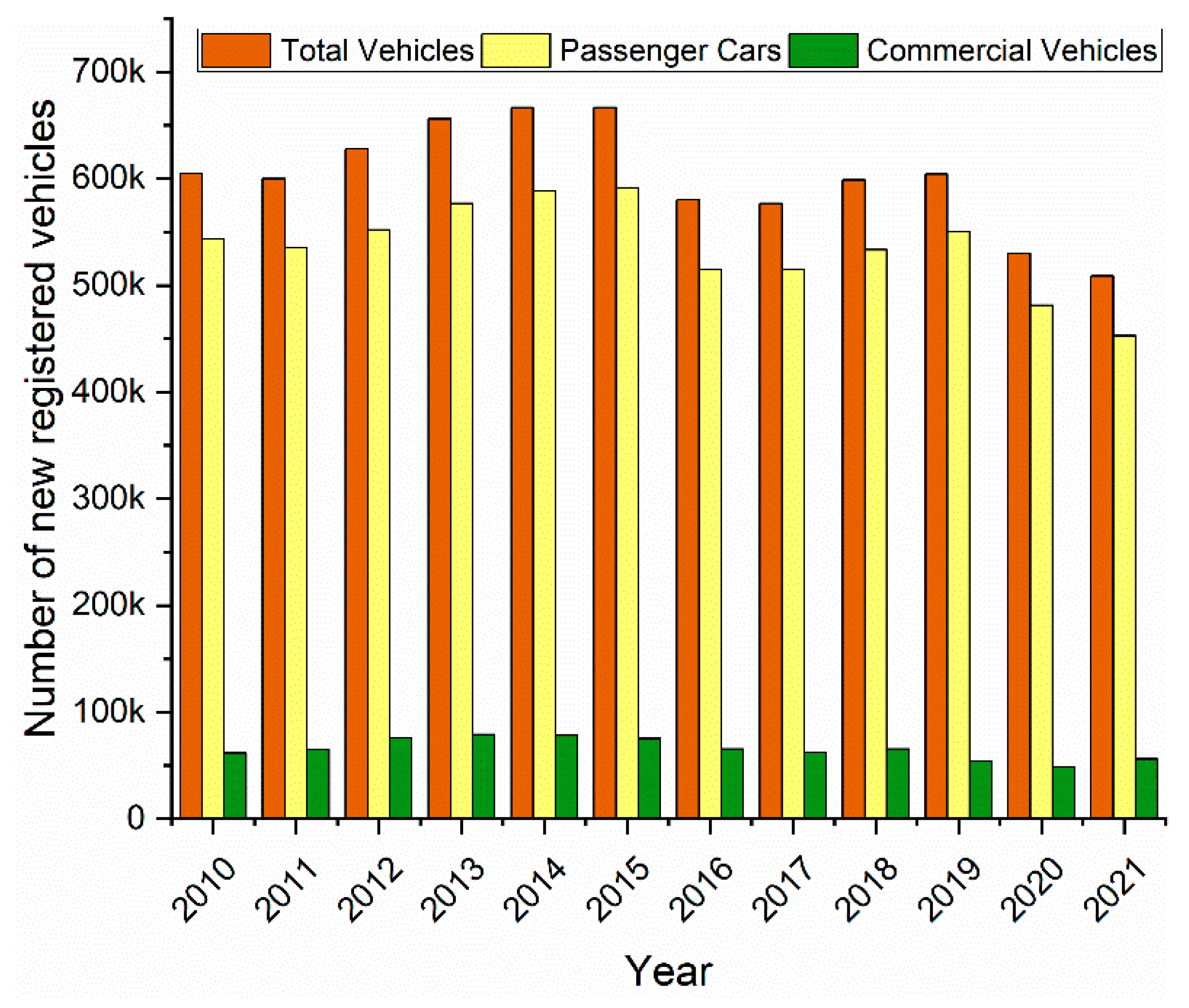

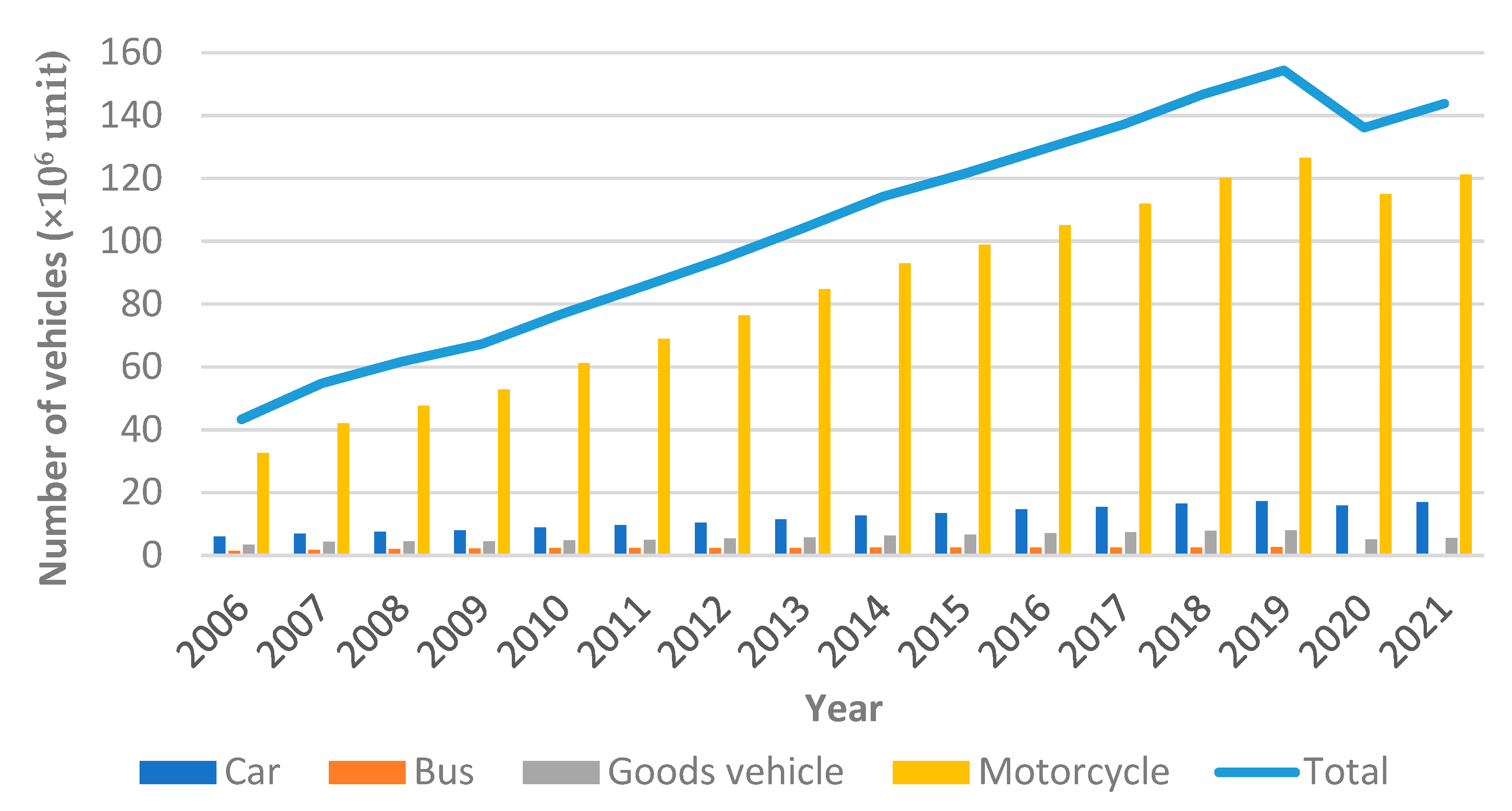

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Malaysia Raises Key Rate As Analysts Bet No More This Year Malaysia Raising Rate

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Education Implementation And Teams Resuscitation

Facebook Fake Account Deletion Per Quarter 2022 Statista

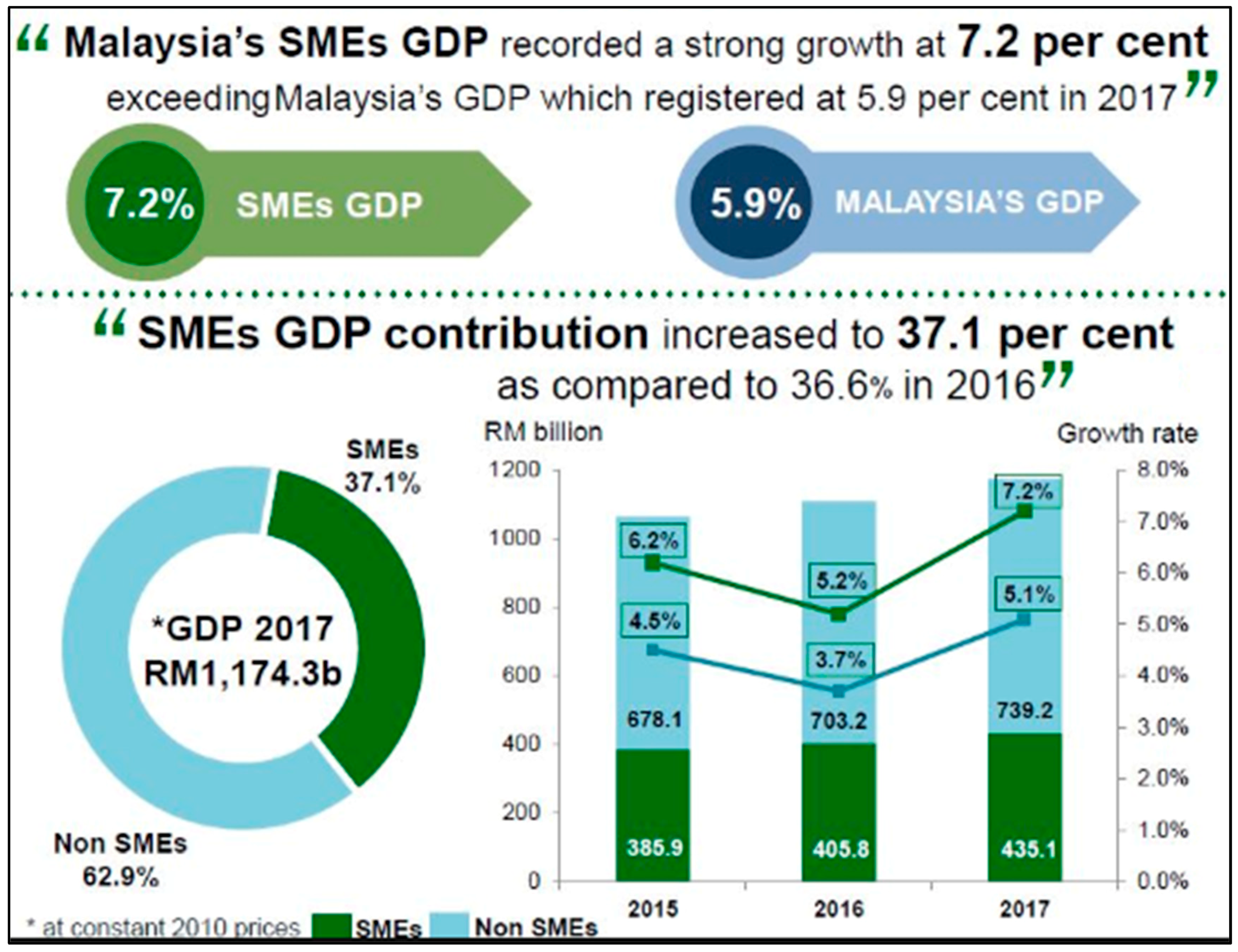

Sustainability Free Full Text The Mediating Role Of Business Strategies Between Management Control Systems Package And Firms Stability Evidence From Smes In Malaysia Html

Global Polypropylene Prices 2022 Statista

Malaysia Polluted Rivers Number 2019 Statista

Facebook Spam Content Deletion Per Quarter 2022 Statista

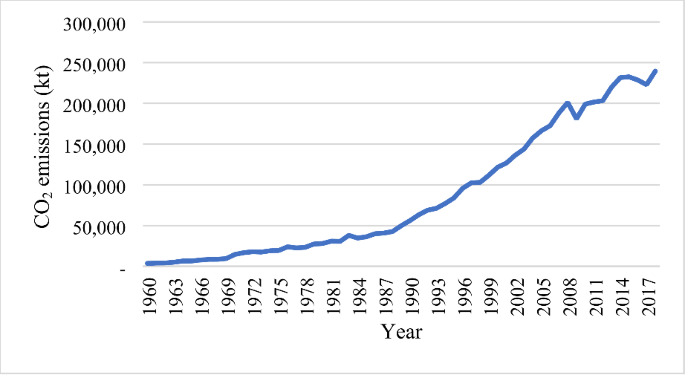

Dynamic Impacts Of Energy Use Agricultural Land Expansion And Deforestation On Co2 Emissions In Malaysia Springerlink

Processes Free Full Text The Challenges Of A Biodiesel Implementation Program In Malaysia Html

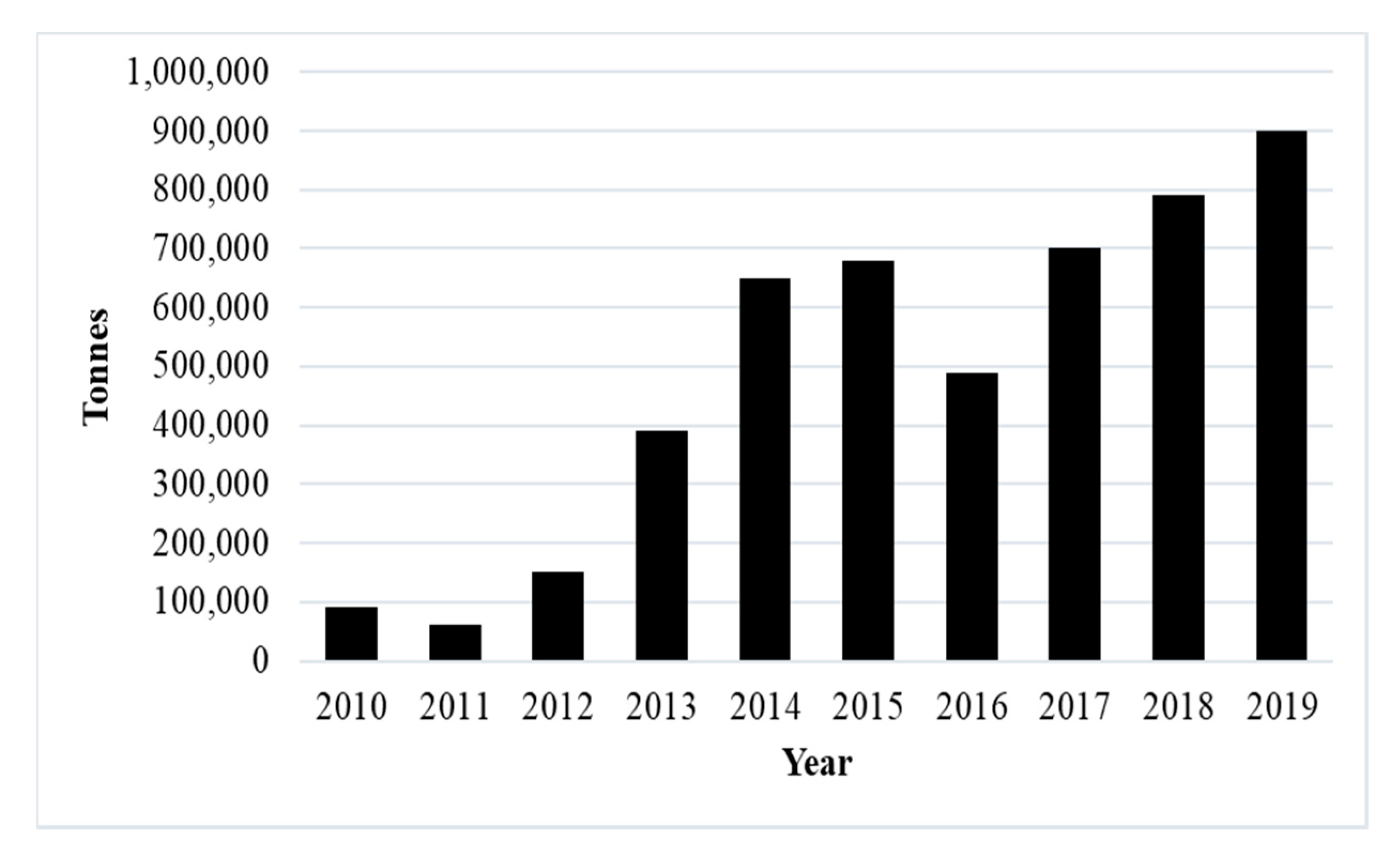

Malaysian Freight And Logistics Market Size Share Analysis 2022 27

Malaysia Gross National Product Gnp Economic Indicators Ceic

Malaysia Social Media Penetration 2021 Statista